VENMO

From domestic only to trusted international payments

Venmo is built for domestic transfers, but today’s users move globally. This case study reimagines Venmo as a fast, travel-ready platform for transparent international P2P payments.

Mobile design

End-to-end experience

YEAR

Nov 2024 - Mar 2025

ROLE

Product Designer

Outcomes

→

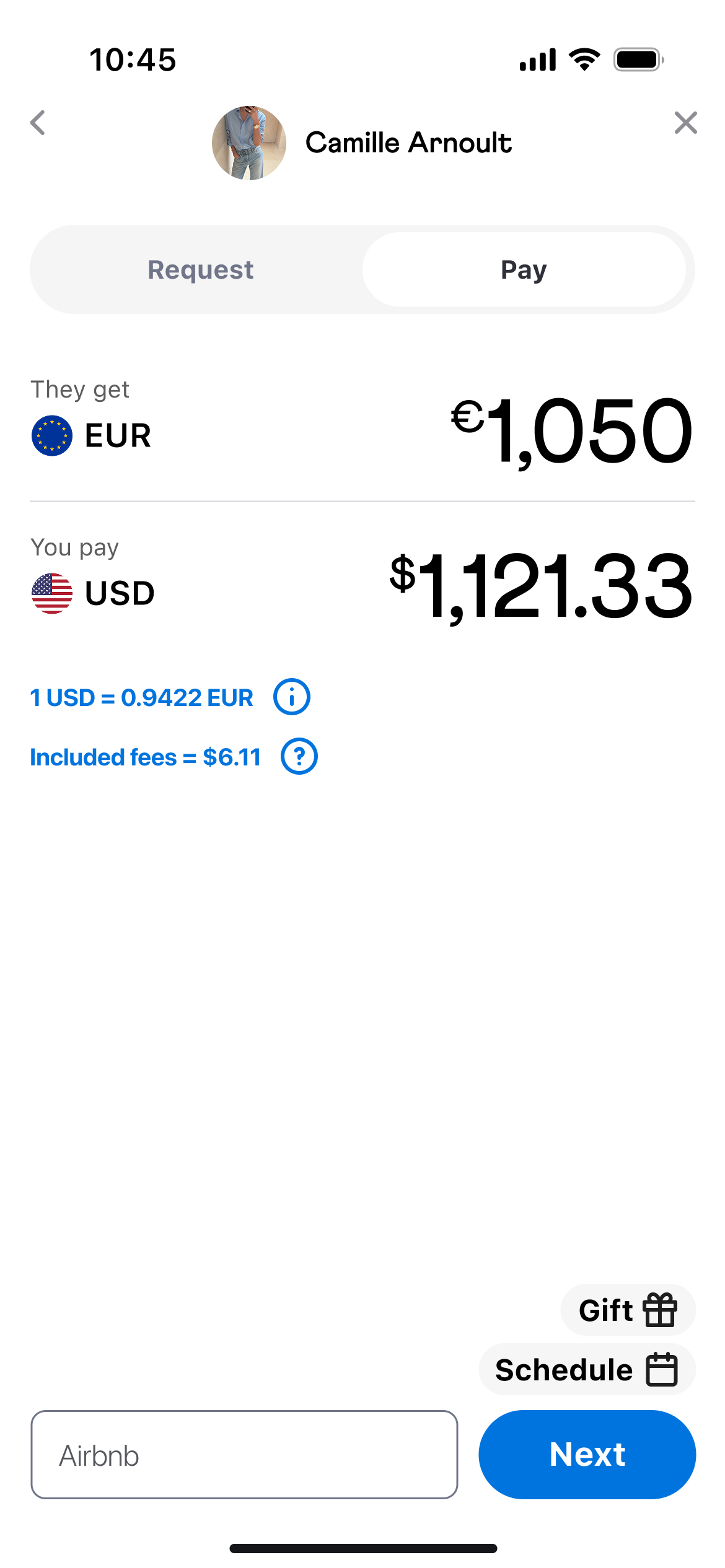

93% average completion rate

Streamlined interactions made payments easier to complete across core flows.

→

100% comprehension lift

Redesigned the send flow to surface conversions, fees, and exchanges rates early by addressing a key user trust barrier from interviews.

→

All users approved the redesigned flow

All users preferred the new international experience over the old flow as trust and confidence improved.

“If Venmo worked like this abroad, I’d stop using everything else. This just makes sense.”

Usability tester,

Product Designer

Context

Why can’t I use Venmo abroad?

Venmo works because sending money feels simple. That ease is the product.

But Venmo relies on domestic banking rails. When users travel or split expenses internationally, the underlying system changes.

The challenge isn’t enabling cross-border payments. It’s preserving that ease as new variables surface in the flow.

Strategic vision: Global P2P payments

Venmo dominates domestic P2P because it removes friction from everyday transfers.

International payments introduce unavoidable complexity. The goal isn’t to eliminate it, but to control how and when it appears in the flow.

The opportunity is to support cross-border transfers while maintaining predictible outcomes and clarity in cost.

The reality of global payments

Why it’s harder than it looks

Venmo’s simplicity relies on domestic banking rails.

Cross-border transfers move through multiple banks and currencies introducing FX volatility, intermediary fees, and regulatory constraints that disrupt that stability.

These variables change the final amount received.

The trust gap

What breaks trust in international payments

Users expect the entered amount to match what the recipient receives.

When those amounts differ, that mismatch introduces doubt at the point of authorization.

When the numbers don’t add up, trust breaks at the interface increasing hesitation and making abandonment more likely.

“Venmo just works in the most simple way possible. If it worked globally and I could trust the rates, I would use Venmo forever.”

Usability tester

“Exchange rates and fees are confusing. I just want to know exactly what I’m paying upfront.”

Usability tester

How might we use cost transparency to preserve trust at the point of authorization?

Reimagining Venmo for a global audience

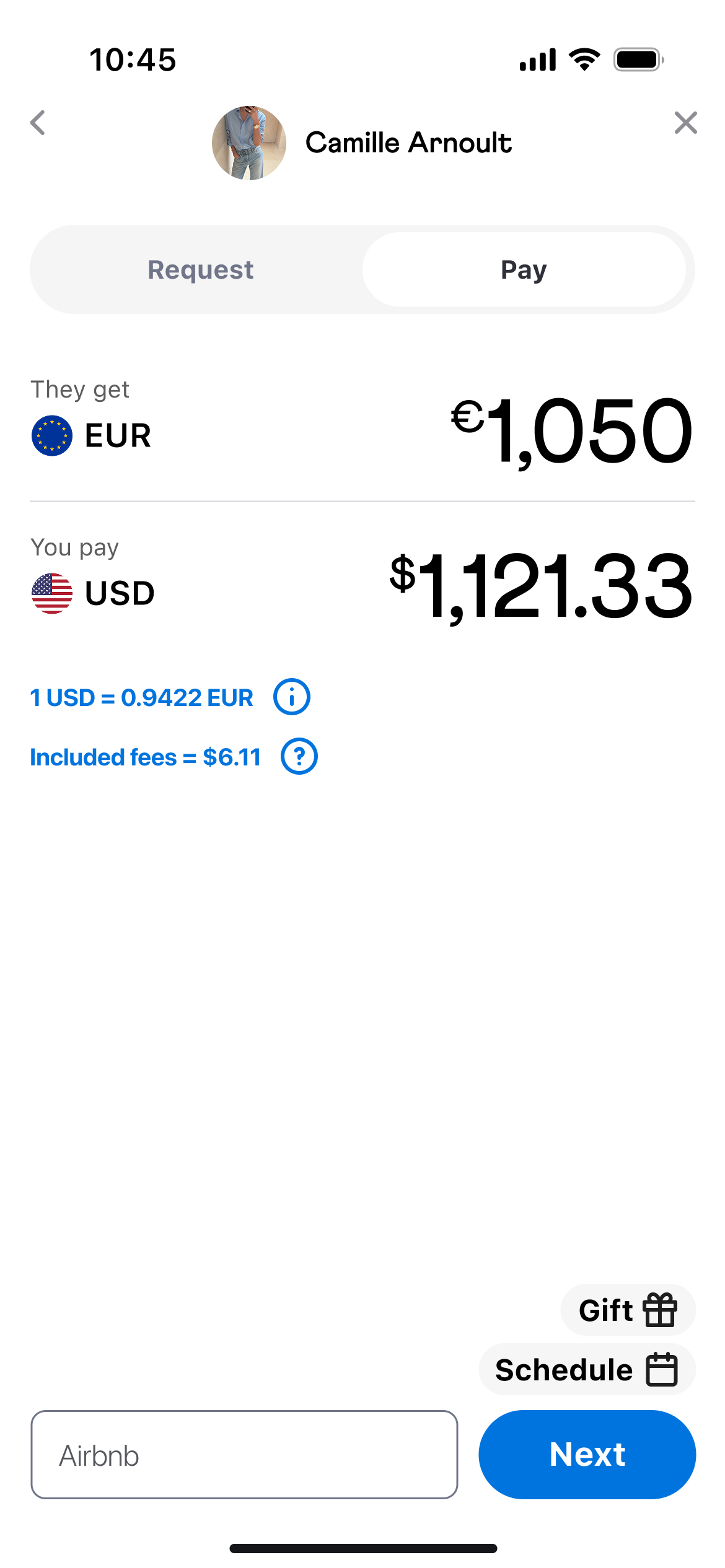

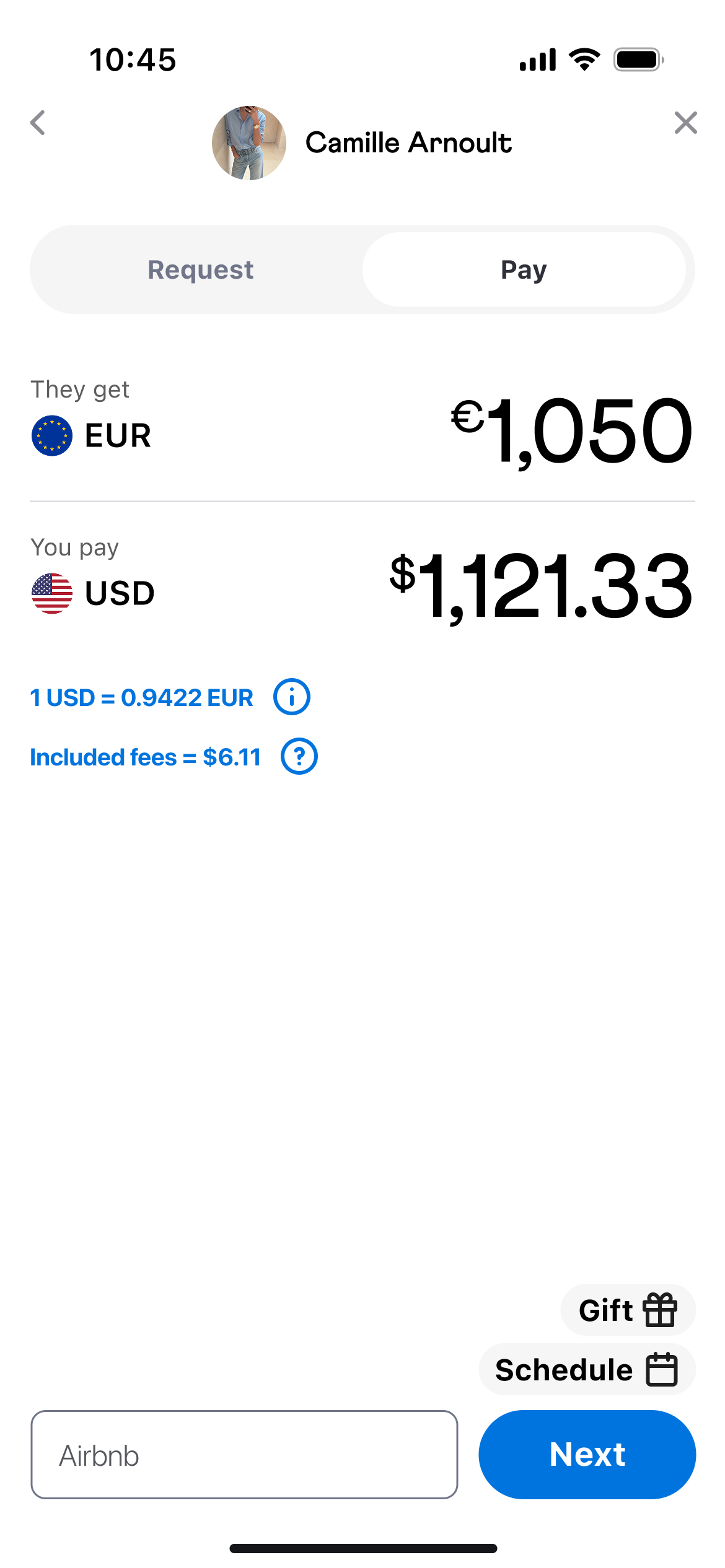

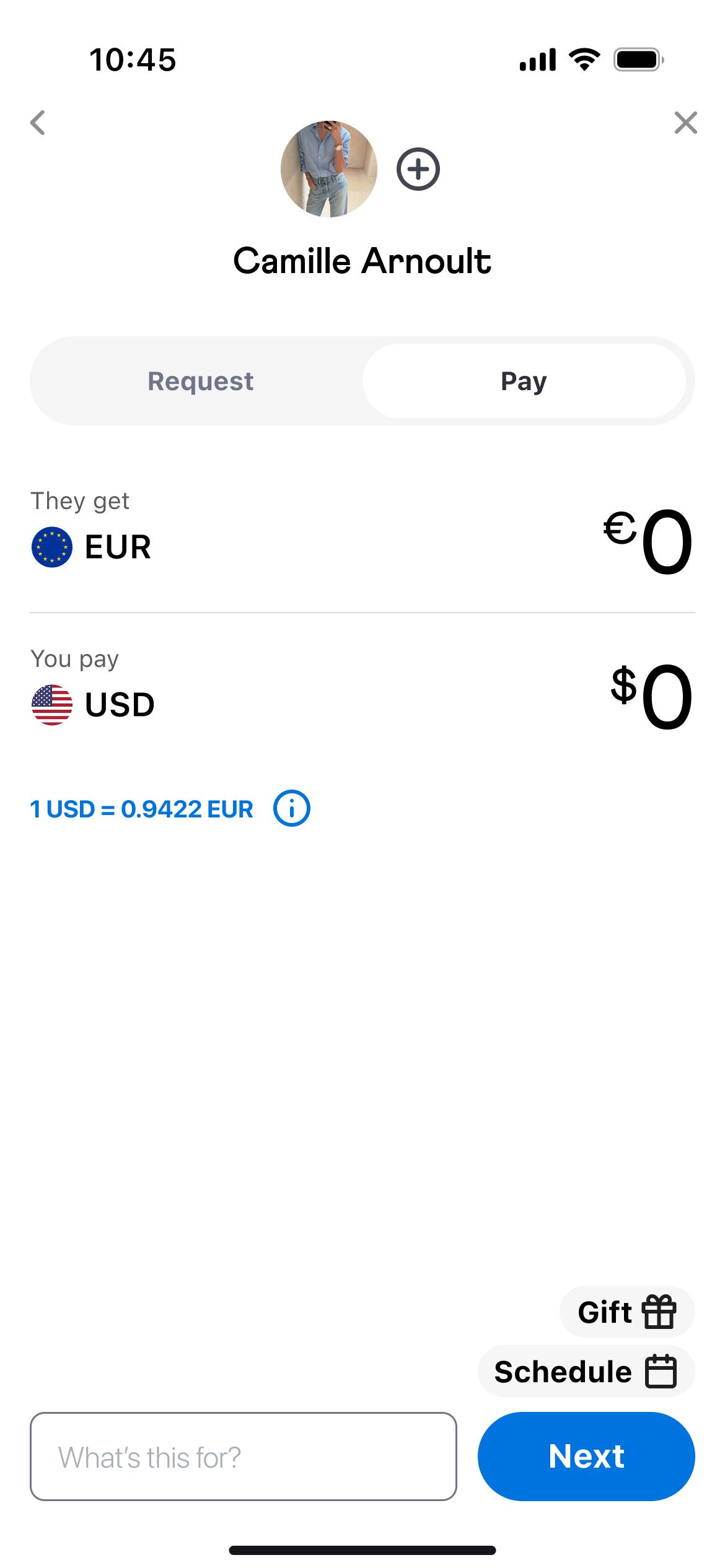

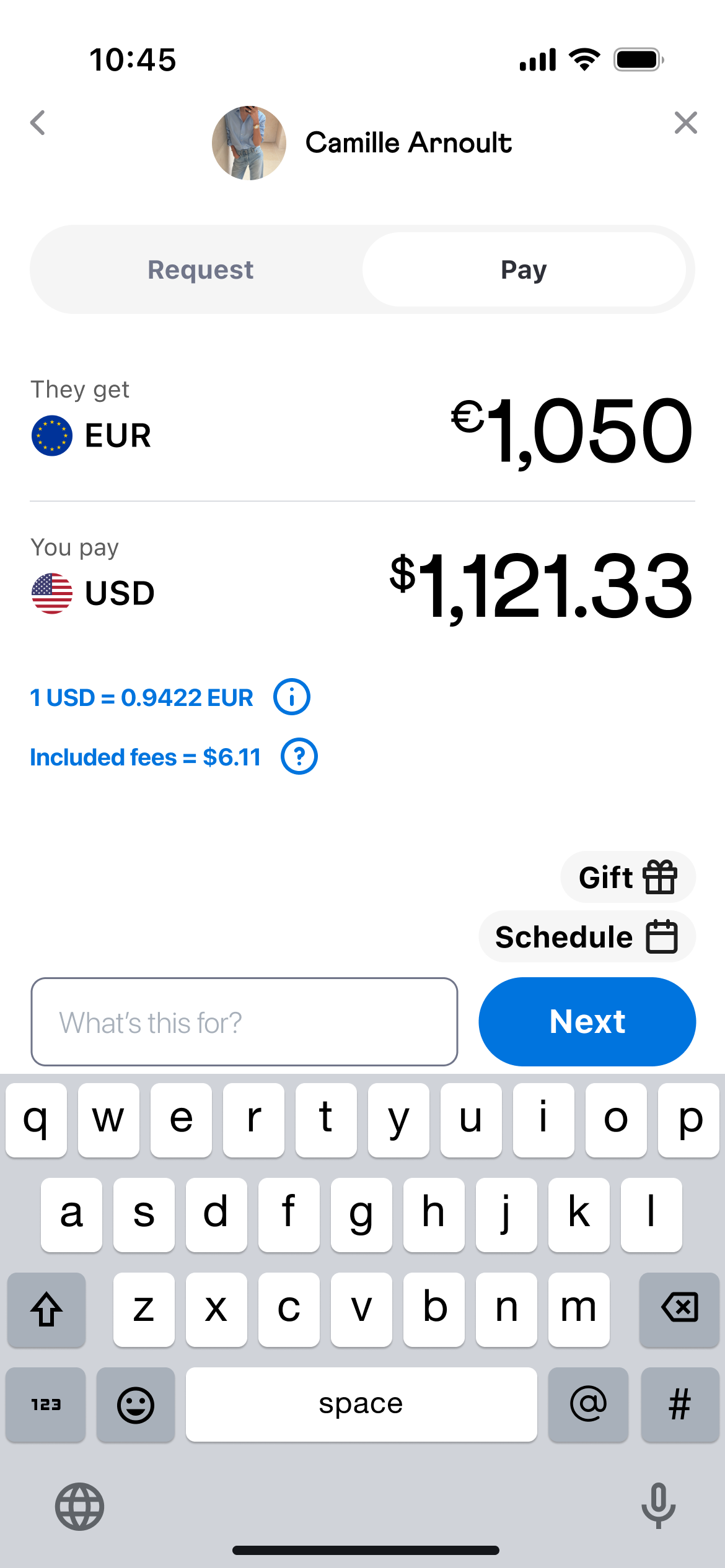

1st MVP: Building trust through transparency

We focused on making the recipient amount clear before confirmation.

Users cared most about how much the recipient would receive. To reflect that mental model, we led with that hierarchy and made exchange rates and fees visible.

Improved clarity and trust with exact totals shown in recipient’s local currency.

100% of participants

felt confident in sending and paying.

Boosted trust and confidence with upfront fee transparency.

All participants

valued upfront fee transparency.

Enabled informed decisions with early exchange rate visibility.

100% of participants

expected early visibility on exchange rates.

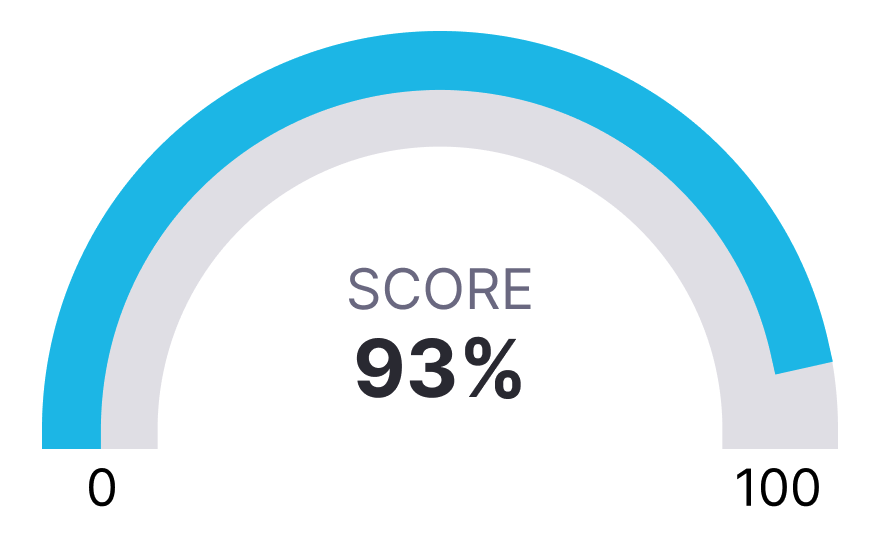

2nd MVP: Clarity without cognitive overload

The 2nd MVP focused on when exchange rates and fees appeared in the flow.

We introduced rates and fees progressively, ensuring nothing felt hidden before confirmation. Layout and copy were adjusted to make total cost explicit.

That sequencing preserved clarity, without disrupting Venmo’s fast, familiar flow.

Exchange rates appear first.

Establishing baseline context without introducing unnecessary cognitive load.

Fees revealed only after an amount is entered.

Ensures users understood the total cost before they decide to send money.

Core experience: 93% average completion rate

The key tasks results were in:

Task

Completed

- International payment

100%

- Checking exchange rates & fees

100%

- Checking included fees

93%

- Sending final payment

100%

- Viewing payment details

82%

- Requesting money

93%

- International request

93%

What if Venmo just worked abroad?

Simple and global P2P

Venmo extends its domestic experience globally by making international payments transparent, so users can complete transfers without hesitation.

SOLUTION 1

Currency clarity

→

Dual-currency display

100% comprehension lift eliminating confusion around global, currency conversions.

→

Mid-market exchange rate display

All users valued early exposure to the exchange rate as it increased trust, clarity, and flow efficiency.

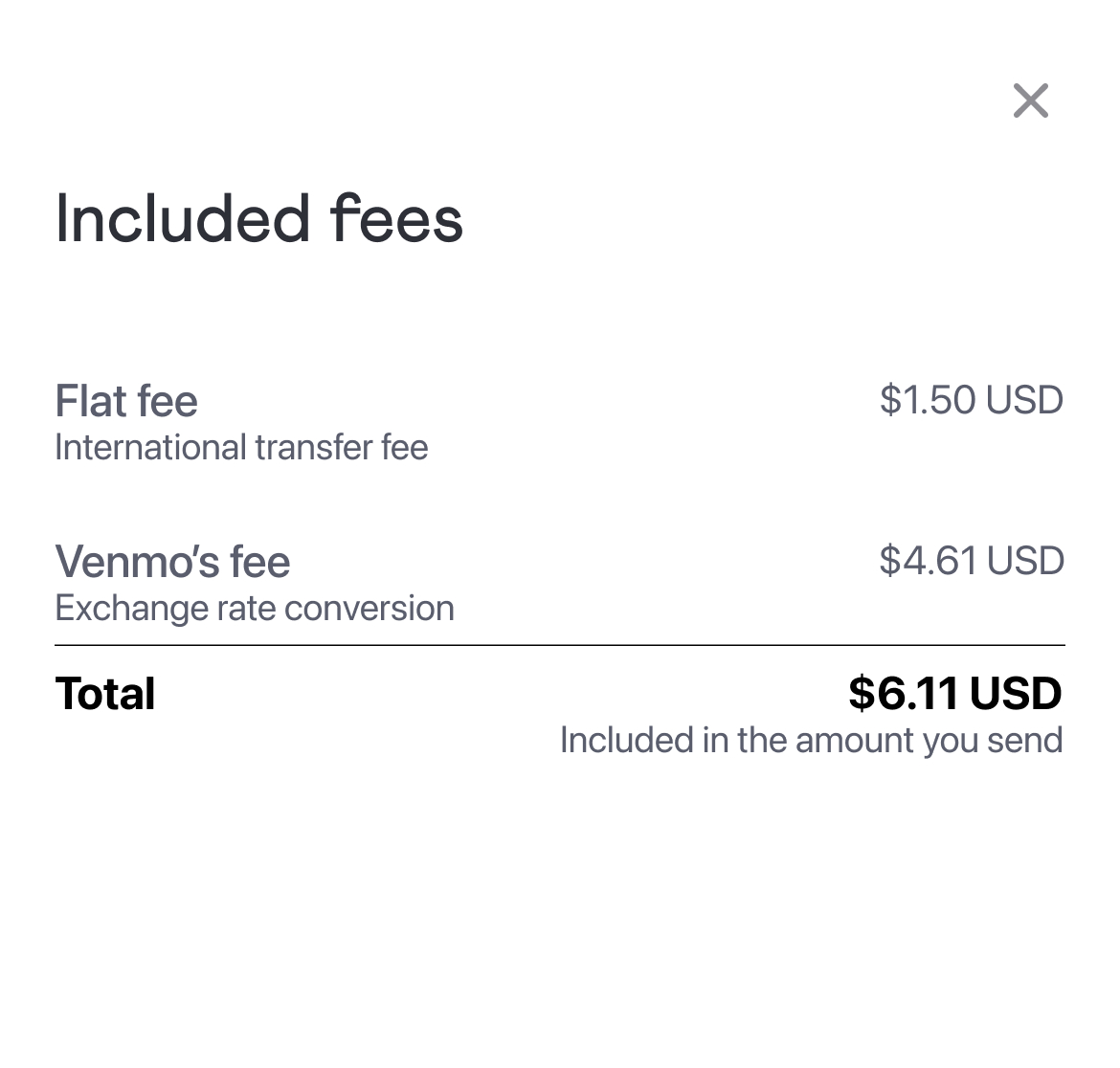

SOLUTION 2

Fee transparency

→

New fee structure

All participants valued the transparent fees being shown early, giving confidence to complete the payment.

→

Integrated exchange rates & competitor rates

88% preferred the integrated rates modal as it reduced screen switching and multiple screen taps.

SOLUTION 3

Simplicity

→

Segmented control

7 of 8 participants found the segmented control easier to use than dual CTA buttons (Pay & Request) as it reinforced intentionality and minimized accidental transfers.

Impact at a glance

Transparency drives trust

In international payments, users hesitate or switch platforms when pricing isn’t explicit.

Clear visibility into total cost reduced hesitation and increased completion.

From trust gap to global growth

A global experience

Venmo now supports international transfers with clear visibility into costs.

Users can complete transfers without hesitation.

“This feels like Venmo, but smarter. I would actually use this when traveling with my friends.”

Usability tester,

Engineer

Next case study

-->

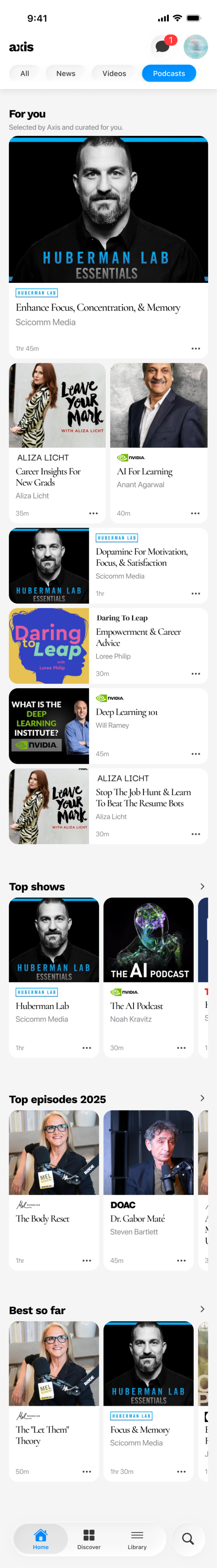

AXIS

Turning exploration into clarity

→

88% adoption rate

→

42% increase in engagement

→

All users discovered unexpected resources

Mobile design

End-to-end experience

View case study